How to Invest in Dubai Real Estate with Confidence

Dubai stands out as a dynamic hub of innovation, luxury, and investment potential. Over the last 20 years, the city has transformed into a mature property market, combining world-class infrastructure with clear regulations and robust demand. Whether you are a first-time buyer or an experienced investor expanding your portfolio, understanding how to navigate this market is essential for long-term success.

What Makes Dubai Unique?

Dubais appeal is driven by several important advantages:

-

No Annual Property Taxes

Investors keep more of their returns thanks to the absence of ongoing property tax and capital gains tax. -

Full Foreign Ownership

Buyers of any nationality can own freehold property in designated zones with full resale and leasing rights. -

Global Connectivity

As a gateway linking Europe, Asia, and Africa, Dubai benefits from continuous business and tourism flows. -

World-Class Infrastructure

Excellent airports, roads, schools, and hospitals create an environment that supports long-term tenant demand. -

Regulatory Clarity

The Dubai Land Department (DLD) and Real Estate Regulatory Agency (RERA) provide clear rules that protect all parties involved.

Establish Your Investment Objectives

Before you shortlist properties, its important to define exactly what you hope to achieve:

-

Are you aiming for consistent rental income, capital appreciation, or a combination of both?

-

Do you plan to live in the property at any stage?

-

What is your intended holding period?

By answering these questions, you can narrow your search to the communities and property types that align with your strategy.

Ready Properties or Off-Plan? Weighing Your Options

Dubai offers investors two main acquisition paths:

Ready Properties

-

Immediately available for leasing or personal use

-

Supported by established pricing and rental records

-

Generate income as soon as the transaction is complete

Off-Plan Properties

-

Often priced more competitively

-

Include payment plans distributed over the construction period

-

Can appreciate in value before completion

Your choice will depend on your timeline, risk tolerance, and budget.

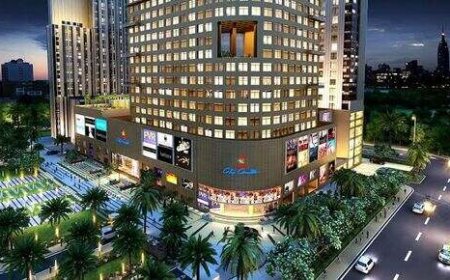

Top Investment Locations in Dubai

Dubais diverse neighborhoods offer unique advantages:

Established Communities

-

Downtown Dubai: Prestigious high-rises near iconic landmarks

-

Dubai Marina: Vibrant waterfront living

-

Business Bay: Popular with professionals and investors alike

Emerging Hotspots

-

Dubai Creek Harbour: A mega-project reshaping the skyline

-

Meydan: Modern villas and apartments in master-planned communities

-

Dubai South: Poised for growth driven by Expo 2020 legacies and logistics development

Choosing the right location is key to securing reliable returns.

Legal Considerations and Compliance

Dubais property laws are designed to protect buyers while ensuring transparency:

-

Freehold Ownership

Foreign nationals can own property in designated areas. -

4% Transfer Fee

Payable to the DLD during registration. -

Escrow Accounts

For off-plan purchases, all payments are secured in RERA-approved escrow accounts. -

Oqood Certificates

Interim ownership documentation until handover. -

Title Deeds

Issued once the property is completed and all dues are settled.

Navigating these requirements with professional guidance ensures your purchase goes smoothly.

The Role of Professional Support

Even the most seasoned investors benefit from local expertise. Working with an experienced real estate agent Dubai offers several advantages:

-

Access to exclusive listings and pre-launch inventory

-

Insights into developers track records and payment options

-

Skilled negotiation of purchase terms and incentives

-

Assistance with all legal paperwork and escrow procedures

-

Help coordinating handover and preparing for leasing

Having a reliable advisor helps you make informed decisions and avoid common pitfalls.

Managing Your Investment Property

Effective management safeguards your returns and keeps your asset in top condition:

-

Marketing and screening tenants

-

Drafting leases and renewals

-

Rent collection and transparent accounting

-

Scheduling repairs and maintenance

-

Obtaining permits for short-term rentals if applicable

Many international investors choose professional management companies to oversee these tasks.

Conclusion: Invest with Preparation and Perspective

Dubais real estate market offers exceptional potential for investors who do their homework and work with trusted partners. When you combine clear goals, an understanding of regulations, and expert guidance, your property can become a long-term asset that delivers income and security.